The truth about Xiaomi's claim to the No. 1 position of the Nepalese smartphone market

Nikhil Shrestha

May 31, 2020

If you follow the Nepalese technology industry (which I'm assuming you do since you're here), a possibly groundbreaking piece of news has been floating around for the past couple of weeks. Amidst all the misfortunes and inactiveness, the domestic smartphone scenario saw a new leader in Q1 2020: Xiaomi. Having entered the Nepalese market officially in March 2016, it's a big milestone for a company. According to the latest 2020 Q1 report from International Data Corporation (IDC), Xiaomi managed to become the "Number 1 smartphone brand in Nepal with a 30.9% market share". It is unarguably a breath of fresh air against the year-after-year dominance of Samsung. Yet, we can't help but feel a little skeptical of how it came to be.

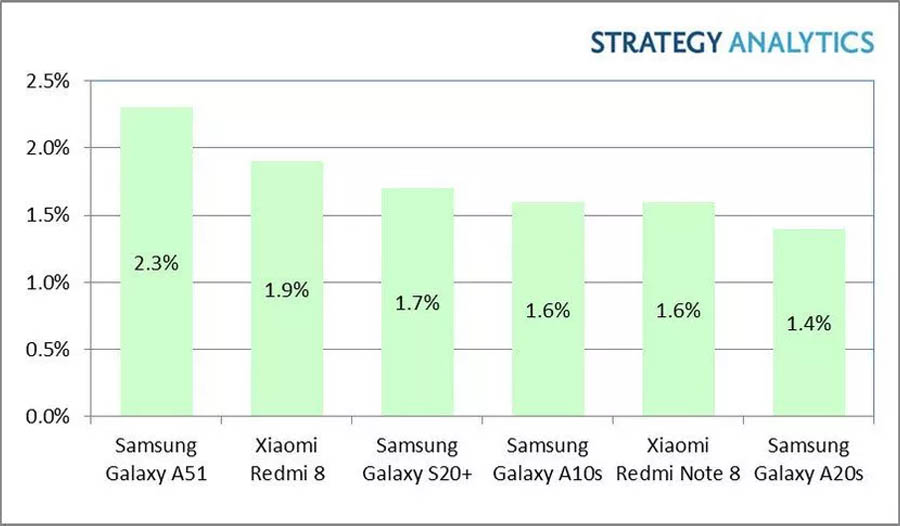

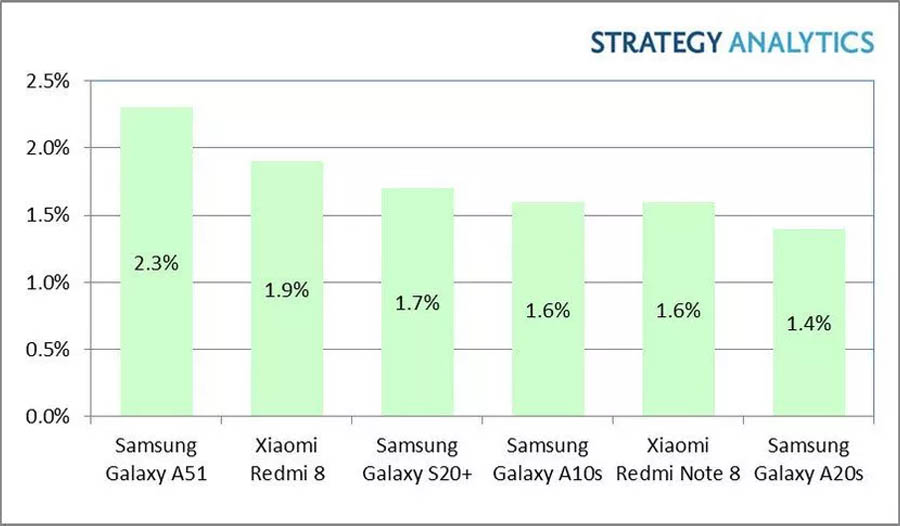

This is the first time Xiaomi has topped the chart in Nepal since its inception. And the success can almost entirely be credited to the beloved Redmi 8/8A and Note 8/Note 8 Pro, which offers insane value for the price and has been the common choice of many smartphone enthusiasts in the country in the budget and mid-range segment, respectively. Redmi Note 8, followed by Redmi 8 were the top 2 smartphones in Nepal during the period. In fact, these phones also managed to crack into the list of top 6 best-selling Android phones worldwide for the first quarter of this year.

More importantly, the brand also actively engages with its fanbase, dubbed the "Mi Fans" that has helped build a good rapport between the customers and the company. And the collective compilation of all these efforts has helped Xiaomi achieve the largest market share in terms of overall smartphone shipments in Nepal during Q1 2020.

More importantly, the brand also actively engages with its fanbase, dubbed the "Mi Fans" that has helped build a good rapport between the customers and the company. And the collective compilation of all these efforts has helped Xiaomi achieve the largest market share in terms of overall smartphone shipments in Nepal during Q1 2020. We all know those big-budget launches weren't going to sell as many units as their inexpensive counterparts. And Samsung knows that as well. As a result, the shipment of phones was considerably low-volume for Samsung in Q1 2020. In spite of this, the company did have plans for launching more affordable options like the Galaxy M21 and M31 during the same period. Yet, that was ultimately scrapped as the COVID-19 pandemic began to take shape across the world, including Nepal.

We all know those big-budget launches weren't going to sell as many units as their inexpensive counterparts. And Samsung knows that as well. As a result, the shipment of phones was considerably low-volume for Samsung in Q1 2020. In spite of this, the company did have plans for launching more affordable options like the Galaxy M21 and M31 during the same period. Yet, that was ultimately scrapped as the COVID-19 pandemic began to take shape across the world, including Nepal.

Xiaomi, Number 1 smartphone brand in Nepal (Q1 2020)

To validate that sentiment, we'll have to understand exactly on what basis the conclusion has been made. IDC's Quarterly Mobile Phone Tracker Q1 2020 (Jan - March) places Xiaomi in the top spot with almost one-third market share while the former kingpin Samsung comes in second.| S. No. | Smartphone Vendor | Market Share |

| 1 | Xiaomi | 30.9% |

| 2 | Samsung | 18.6% |

| 3 | Vivo | 12.3% |

| 4 | OPPO | 10.0% |

| 5 | Lava | 5.3% |

Few words from Mr. Kothari

Sourabh Kothari (Country General Manager, Xiaomi Nepal) had the following to say regarding the triumph:"This is an exhilarating moment for us at Xiaomi Nepal, as we become the leader in the smartphone market for the very first time. Driven by our mission to bring innovation for everyone, we shall strive to work even harder for our Mi fans.We are so grateful for the immense love and support we have received from our Mi Fans, who have believed in us every step of the way. The journey since our start here has been a humbling experience and I truly believe we will become an even bigger part of people’s lives with our commitment to gain our users’ love and trust through best specs, highest quality, and honest pricing."Hard work pays off, indeed

Besides a confident product line itself, Xiaomi has gradually expanded its foothold in the offline market as well; seeing its prime importance in the country. To date, the company has set up more than 900 offline partners and 350 Mi Preferred Partner shops in Nepal alongside a strong nationwide distribution network. Xiaomi Nepal relies heavily upon digital platforms to market its products, with frequent offers, sales carnivals, etc. organized frequently.

A matter of technicality

You see, that's exactly where things sound a little hesitant. According to IDC, the "units shipments" consists of the number of new smartphones shipped by a vendor to all distribution channels or directly to end-consumers. What we can infer from this is that the tracker methodology doesn't specify whether or not the shipment volume is exclusive to one channel of distribution. The thing is, on a business of this magnitude, sales distribution occurs in three different stages:- Primary: From national distributors (ND) to regional distributors (RD)

- Secondary: From regional distributors to mobile shops

- Tertiary: From mobile shops to end consumers

How does IDC obtain its data?

In the process of obtaining tracker data, IDC's methodology involves different sources. Some of them are as follows:- In-country local vendor interviews

- Distribution data feeds

- Worldwide and regional vendor guidance

- ODM (Original Design Manufacturer) data

- In-country local channel partner discussions

- Import & Export records

- Feedback from component suppliers

- Vendor briefings and public financial reports

Why Samsung failed in Q1 2020

IDC specifically mentioned how Samsung struggled with supplies during Q1 2020; which was the gateway to Xiaomi becoming the number 1 smartphone brand in Nepal. The company had launched the expensive & flagship Galaxy S20 series and two upper mid-range phones; Galaxy A51 and A71 in March. And during January, February, Samsung was mostly operating with what it had in stock; phones from Q4 2019, by offering discounts, cashback, etc.

The bigger challenge ahead for Xiaomi

So, despite the actual figure of tertiary sales remaining in the shadows, Xiaomi Nepal does have a benefit of the doubt. Its phones were doing quite well in the country, which ultimately led to the increment in shipment units. However technical, we're delighted to see Xiaomi rise in the Nepalese smartphone scene in such a short time.Now, the company has one giant task in its hand: to maintain the market lead. That's certainly not going to be easy. Nevertheless, if the company sticks to its basics by launching affordable smartphones at competitive prices, it may just work out. After all, the budget and mid-range smartphones are what buyers in a developing country like ours opt for.

To say something about myself, I have been writing tech and gadgets from 2021. Although coming from a non technical studies background, I'm someone who is always fascinated by the latest gadget and tech innovations, circling around. Besides writing, you'll find me listening music and aligning the stars through astrology and sometimes even, tarot cards! 😉🧿

Comments

No comments yet. Add a comment to start a discussion