It’s no secret that the smartphone accessories market is on the rise here in Nepal. With most people already owning a smartphone, they are looking to complement it with a smartwatch, wireless earbuds, and such. So while most of us expected Indian brands to dominate the accessories market in Nepal as well, that couldn't be farther from the truth. Instead, it's the Nepali OEM accessories brands that are leading the charge. Source: Counterpoint[/caption]So in a price-sensitive market like ours, it's only natural to think that these Indian accessories brands could have the same market effect in Nepal as well. However, the few Indian companies that have officially entered the Nepali market — like boAt, Noise, and Mivi — haven't found similar success here.Now, research firms like Counterpoint, IDC, and Statista don't really keep track of wearable shipments in a tiny market like ours.But from what we've gathered after extensive research with multiple retailers and e-commerce platforms, we found that Nepali and Chinese OEMs actually have a much stronger foothold in Nepal's accessories market. And Nepali brands like Ultima, Purple, Kick, and Gravity have been doing especially well in catering to the needs of the domestic audience.

Source: Counterpoint[/caption]So in a price-sensitive market like ours, it's only natural to think that these Indian accessories brands could have the same market effect in Nepal as well. However, the few Indian companies that have officially entered the Nepali market — like boAt, Noise, and Mivi — haven't found similar success here.Now, research firms like Counterpoint, IDC, and Statista don't really keep track of wearable shipments in a tiny market like ours.But from what we've gathered after extensive research with multiple retailers and e-commerce platforms, we found that Nepali and Chinese OEMs actually have a much stronger foothold in Nepal's accessories market. And Nepali brands like Ultima, Purple, Kick, and Gravity have been doing especially well in catering to the needs of the domestic audience.

Let's take the newly launched Ultima Nova Watch Pro for instance. It brings an AMOLED screen, IP68 rating, Bluetooth calling, and all the basic health tracking you ask for at just NPR 3,999. Whereas something similar from an Indian brand costs more than twice as much here, like the Noise ColorFit Ultra 2. Even if it was priced with a direct conversion from Indian to Nepali rupees, it still ends up being costlier than the Watch Nova Pro. Whereas the Noise ColorFit Ultra 2 is expensive by more than 60% here in Nepal, which is just ridiculous.

Even if it was priced with a direct conversion from Indian to Nepali rupees, it still ends up being costlier than the Watch Nova Pro. Whereas the Noise ColorFit Ultra 2 is expensive by more than 60% here in Nepal, which is just ridiculous. Take boAt's "Wave Lite" for example. This affordable smartwatch was launched back in March 2022 in India but wanna guess when it made its way here? Nepali customers had to wait a full year till March 2023 before they could get their hands on it. Not only does such a delayed launch kill any hype for the product, but it also negatively affects the buyer's perception of the brand in the long run.

Take boAt's "Wave Lite" for example. This affordable smartwatch was launched back in March 2022 in India but wanna guess when it made its way here? Nepali customers had to wait a full year till March 2023 before they could get their hands on it. Not only does such a delayed launch kill any hype for the product, but it also negatively affects the buyer's perception of the brand in the long run. And like I said before, a few Chinese OEM brands like MyPower have amassed quite a popularity in the Nepali mobile accessories market. The company sells everything from wired/wireless earbuds to speakers, powerbanks, data cables, and more. And like most Nepali OEM brands, MyPower has been able to maintain aggressive pricing alongside good channel margins too.

And like I said before, a few Chinese OEM brands like MyPower have amassed quite a popularity in the Nepali mobile accessories market. The company sells everything from wired/wireless earbuds to speakers, powerbanks, data cables, and more. And like most Nepali OEM brands, MyPower has been able to maintain aggressive pricing alongside good channel margins too.

What are smartphone accessories, really?

Now, there are different types of electronic gadgets that fall under the "smartphone accessories" umbrella. Including wearables and hearables like smartwatches, smart rings, fitness bands, wired/wireless earbuds, speakers, and more. Whereas things like mobile chargers, cables, powerbanks, and so on also fall into this category.The global influence of Indian accessories brands

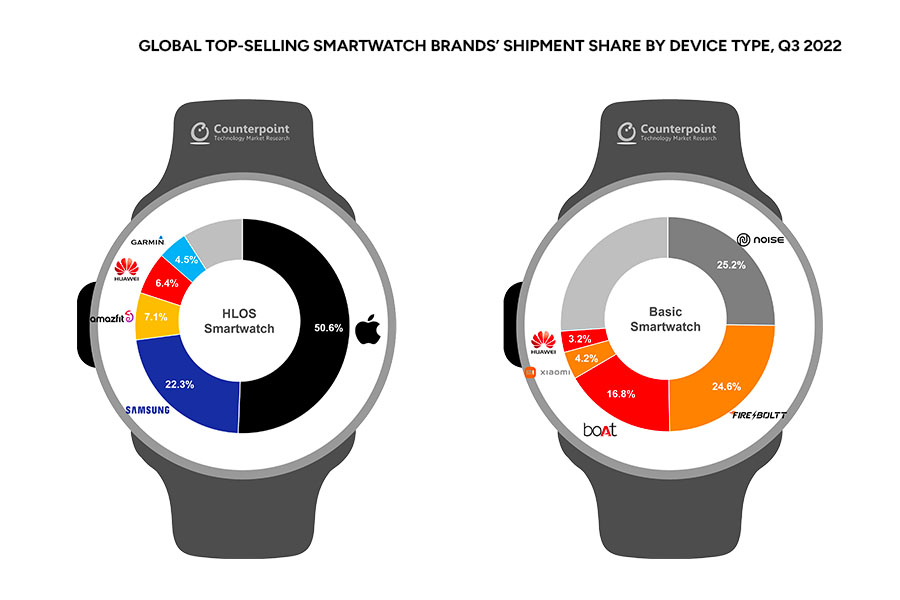

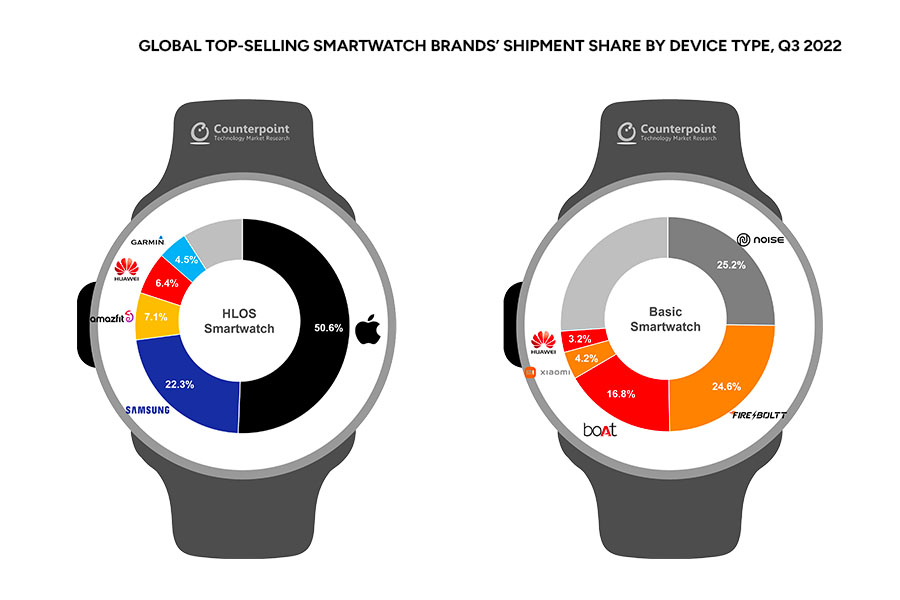

And when it comes to smartwatches and TWS earbuds, Indian brands have been crushing it lately. Mostly in the budget segment, which has helped propel brands like boAt, Noise, and Fire-Boltt to rank among the top brands globally in terms of market share.[caption id="" align="alignnone" width="900"]

Why are Nepali OEM brands leading the accessories market?

1. Price

Okay, the main (and the most obvious) reason why Nepali OEM accessories brands have been doing well is because of their super-aggressive pricing. If brand A is offering a similar set of features at a much cheaper price than brand B, that immediately makes a customer's buying decision easier. And while Nepali and Chinese OEMs have been extremely competitive when it comes to price, I can't say the same for Indian accessories brands.| Ultima Watch Nova Pro | Noise ColorFit Ultra 2 | |

| Body | Zinc alloy metal case | Stainless steel case |

| Display |

|

|

| Connectivity | Bluetooth 5.3 | Bluetooth 5.1 |

| IP rating | IP68 | IP68 |

| Health tracking | Heart rate, SpO2 (Blood oxygen), Menstrual cycle, Sleep, Step, Stress monitoring | Heart rate, SpO2 (Blood oxygen), Menstrual cycle, Sleep, Step, Stress monitoring |

| Fitness | 100+ workout modes | 60+ workout modes |

| Bluetooth calling | Yes | No |

| Price in Nepal (Official) | NPR 9,799 | |

| (INR 3,799 in India) |

An easy choice

As you can see, these two are very comparable smartwatches. And the Nova Pro also has a few standout features like Bluetooth calling and newer Bluetooth 5.3 connectivity. Obviously, the spec sheet alone can't paint the complete picture of a product. But if you look at their prices, the ColorFit Ultra 2 is at a clear disadvantage.

2. Channel margins

Another part of the equation is the margin these brands give to the retailers. Even though online shopping has been booming in Nepal in recent years, brick-and-mortar stores still make up a big majority of the market. And here, channel margin refers to the difference between the price to the seller and the price to the customer. AKA the profit margin for the retailers.So if brand X provides higher margins than brand Y, retailers have more incentive to push their products over the competition. It’s a delicate balance to master though as giving higher margins might result in inflated prices or minimal profit to the manufacturer.Luckily, most Nepali OEM brands don’t have to deal with expenses like RND, factory maintenance, and so on. As a result, they can be more "generous" in this regard. And because of this, they have a good rapport with Nepali retailers.Wait a minute...

When you think about it though, it's almost odd that such massive Indian OEM brands would have a hard time maintaining competitive prices and keeping the retailers happy. After all, they have all the experience and resources in the world to make it happen.But instead of incompetence, it's more like such Indian brands neglecting the Nepali market. They've got a much bigger fish to fry in their home country itself, so why waste resources on such a small market like ours? And this is also evident with the product launches from Indian OEMs here in Nepal.

What about Chinese OEM brands?

Final words

In conclusion, Nepali OEM brands are seeing huge growth in sales and dominating the domestic mobile accessories market. Whereas despite their grand success in India, brands like boAt, Noise, and Mivi haven't found much success here. And on the current trajectory, the future for Nepali brands like Ultima, Josh, Kick, Gravity, and Purple looks plenty bright.- Watch: The problem with Nepali brand ft. AstaWolf

To say something about myself, I have been writing tech and gadgets from 2021. Although coming from a non technical studies background, I'm someone who is always fascinated by the latest gadget and tech innovations, circling around. Besides writing, you'll find me listening music and aligning the stars through astrology and sometimes even, tarot cards! 😉🧿

Comments

No comments yet. Add a comment to start a discussion